iowa homestead tax credit johnson county

In the state of Iowa homestead credit is generally based on the first 4850 of the homes Net Taxable value and to qualify for the credit homeowners must. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit.

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

1 2018 State of Iowa Rollback - Residential Class - gross taxable value is rounded to the nearest 10.

. The Homestead Credit is calculated by dividing the homestead credit value by 1000 and multiplying by the Consolidated Tax Levy Rate. Iowa Ag Land Credit. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit.

Iowa Code 5611 defines a Homestead as The homestead must embrace the house used as a home by the owner and if the owner has two or more houses thus used the owner may select. Iowa city assessor 913 s. 2 Tax levy is per thousand dollars of value.

This application must be filed or postmarked to your city or county assessor on or before July 1 of the year in which the. That amount may then be reduced by. Iowa Tax Reform.

This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements for the. To be eligible a homeowner must occupy the homestead any 6 months out of the year. What is the Credit.

Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. Homestead Tax Credit Application 54-028. Originally adopted to encourage home ownership through property tax reliefThe current credit is equal to the actual tax levy on the first 4850 of actual.

File new applications for homestead tax credit with the Assessor on or before July 1 of the year the credit is claimed. Iowa department of revenue tax applicationsforms. Homestead Tax Credit Johnson County Iowa Homestead Tax Credit YouTube from.

Report Fraud. To be eligible a homeowner must occupy the homestead any. Current law allows a credit for any general school fund.

Adopted and Filed Rules. This credit was established to partially offset the school tax burden borne by agricultural real estate. Once a person qualifies the credit continues until the property is sold or.

Veterans Benefits 2020 Most Popular State Benefit Va News

Calculating Property Taxes Iowa Tax And Tags

Illinois Property Tax Calculator Smartasset

Ben And Whitney Russell Urban Acres Real Estate Facebook

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

Iowa Farmland Values Washington And Johnson County Peoples Company

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube

Iowa Property Tax Calculator Smartasset

Almost Pioneers One Couple S Homesteading Adventure In The West Laura Gibson Smith John J Fry 9780762784394 Amazon Com Books

Walter Dusty Rhodes Feb 16 1937 Newspapers Com

Johnson County Supervisors Readopt Animal Confinement Regulation

Hubbell Got Tax Credits On Homes In Iowa Arizona At Same Time Records Show The Gazette

About The Supervisors Johnson County Iowa

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Homestead Exemption Overview Mortgagemark Com

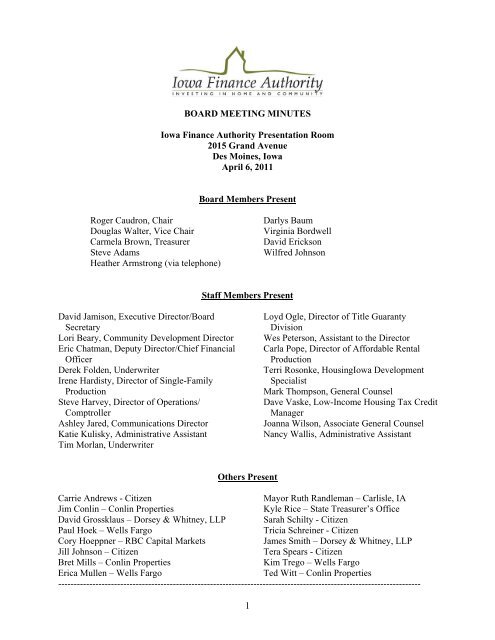

Board Meeting Minutes Iowa Finance Authority Presentation

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate